Another look at Winnipeg’s council pension

In April 2020, SecondStreet.org examined the cost of the pension benefits for Winnipeg’s City Council.

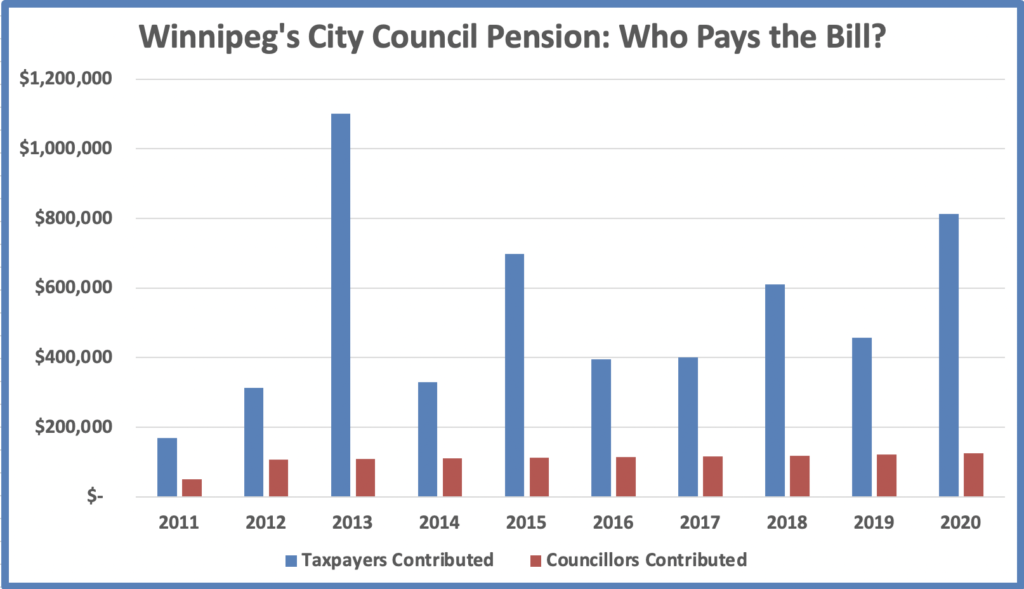

At the time, we calculated a very lopsided situation – taxpayers put in $4.73 for every $1.00 put in by council.

Since then, contributions from taxpayers have increased.

Over the most recent 10-year period for which data is available (2011-2020), the portion picked up by taxpayers has increased to $4.89 for every $1.00 put in by council members:

Taxpayers paid: $5,286,567

Councillors paid: $1,081,690

You can see all the data sources if you – click here.

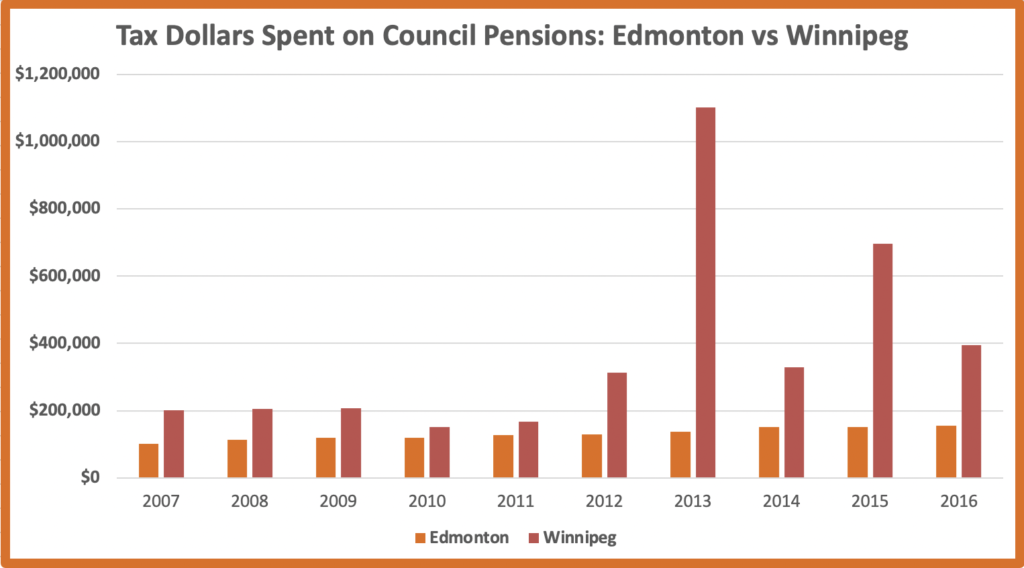

In short, the City of Edmonton lets council members choose between:

* 11% contribution by the to the elected official’s total annual salary to support retirement; or

* 12% contribution by the City of Edmonton directed to Alberta Urban Municipalities Association (AUMA) Defined Contribution Pension Plan

In the first scenario, Edmonton council members invest their funds as they see fit and have to make do with whatever returns they receive – no one bails them out if their investments plummet. Under the second scenario, the same happens, but a pension body invests the funds on the member’s behalf. Again, there are no bailouts if the investments plummet.

In Winnipeg, it’s completely different.

Council members receive a generous payout for the rest of their lives, one that rises at 80% the rate of inflation. If their pension fund doesn’t have enough money, then taxpayers contribute more money into the plan. That’s what usually drives the spikes in spending that you see in the graphs above.

Edmonton’s retirement benefits may not be as generous as Winnipeg’s, but it’s still better than what 77% of those who work outside of government receive – no workplace pension at all.

What we noted last year is worth repeating – “Unless Winnipeg fundamentally changes the structure of its council pension plan, taxpayers should expect to pay more and more in the years ahead to continually bail it out.”

By: Colin Craig, President of SecondStreet.org

colin@secondstreet.org

You can help us continue to research and tell stories about this issue by making a donation or sharing this content with your friends. Be sure to sign up for our updates too!